The authoritative Swiss Ramble reckons there may be more to play for than is generally realised. As a reminder, in 2018/19 each club received equal shares for 50% of domestic TV £34m, overseas TV £43m and commercial income £5m. Each match broadcast live was worth £1.1m (on top of £12.2m for a minimum of 10 games), while each league position was worth £1.9m (merit payment).

Total 2019-22 Premier League TV rights rose 8% (£0.7 bln) from £8.5 bln to £9.2 bln. UK domestic rights actually fell 7% (£0.4 bln) from £5.4 bln to £5.0 bln, but this decrease was more than offset by overseas rights increasing by 34% (£1.1 bln) from £3.1 bln to £4.2 bln.

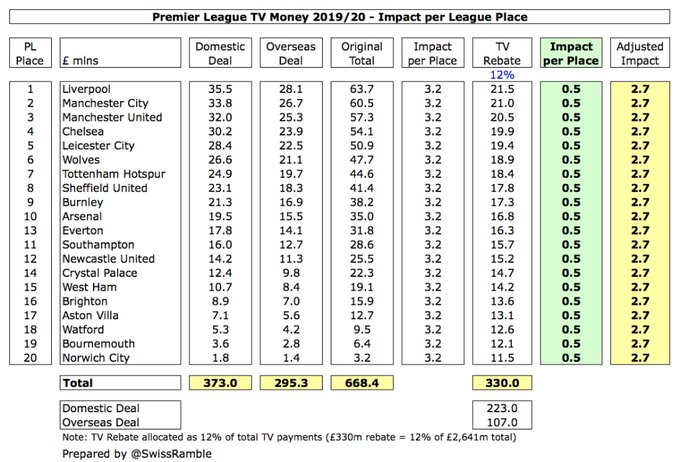

Overseas rights now average around £1.4 bln a year, up from £1.1 bln in the 2016-19 cycle, accounting for 45% of the total. As recently as 2007-10, these were only worth £200m a year. Overseas TV rights were previously distributed as equal shares by the Premier League, but this was changed in the 2019-22 deal. Clubs will continue to share current levels of overseas revenue equally, but any increase will be distributed based on where they finish in the league.

This means that the amount of money distributed based on league position has significantly increased to £668m, comprising domestic rights £373m plus overseas rights £295m. In this way, each league position in 2019/20 is worth £3.2m (up from £1.9m in 2018/19). One consequence is that the gap to the Big Six is likely to grow.

If we further assume that the rebate [to broadcasters] is based on league position, i.e. the more money a club receives, the higher the rebate, then each place would mean an additional £0.5m towards the rebate. Therefore, the net rebate in 2019/20 would be £2.7m (£3.2m less £0.5m).

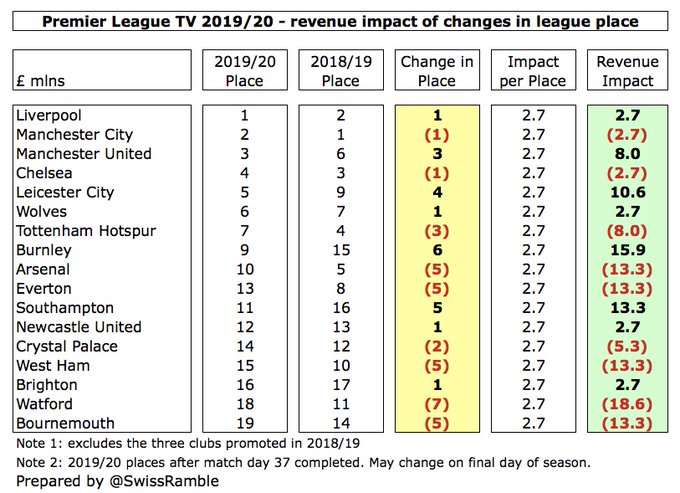

In summary, the amount of money each league position is worth was £1.9m in 2018/19, increased to £3.2m with the new TV deal in 2019/20, but has been reduced to a net £2.7m, due to the rebate owed to broadcast companies for the delayed matches caused by the pandemic.

This can mean some chunky moves in each club’s TV distribution. For example, looking at the Premier League table after match day 37, Burnley would receive £16m more (rising from 15th last season to 9th), while Watford would get £19m less (dropping from 11th to 18th).

Arsenal are currently down £13m, having dropped from 5th to 10th. If they win their last match against Watford, they could move up to 8th (depending on results elsewhere), which would be worth an additional £5.4m to Arsenal.

Comments

Post a Comment