The Swiss Ramble is now able to calculate Premier League television distributions, although he emphasises that these are estimates.

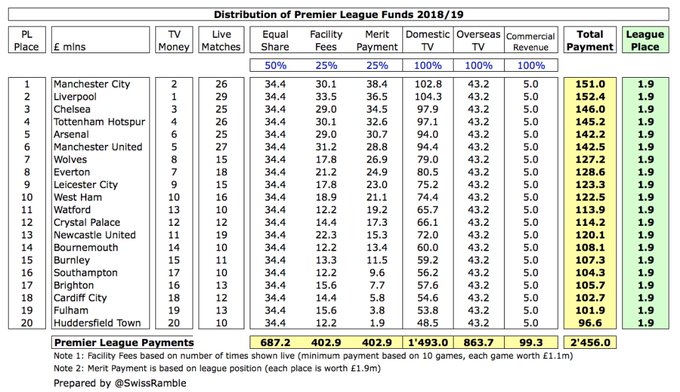

As a reminder, in 2018/19 each club received equal shares for 50% of domestic TV £34m, overseas TV £43m and commercial income £5m. Each match broadcast live was worth £1.1m (on top of £12.2m for a minimum of 10 games), while each league position was worth £1.9m (merit payment).

However, the story has changed with the new 3-year deal for the 2019-22 cycle, as the numbers have moved and there is a twist in the distribution methodology used for the overseas TV rights. This is important, as overseas is the area driving the growth in TV money.

Total Premier League TV rights rose 8% (£0.7 bln) from £8.5 bln to £9.2 bln. UK domestic rights actually dropped 7% (£0.4 bln) from £5.4 bln to £5.0 bln, but this decrease was more than offset by overseas rights increasing by 34% (£1.1 bln) from £3.1 bln to £4.2 bln.

As can be seen, the increase in PL overseas TV rights is particularly striking. These now average around £1.4 bln a year, up from £1.1 bln in the 2016-19 cycle, accounting for 45% of the total. As recently as 2007-10, these were only worth £200m a year.

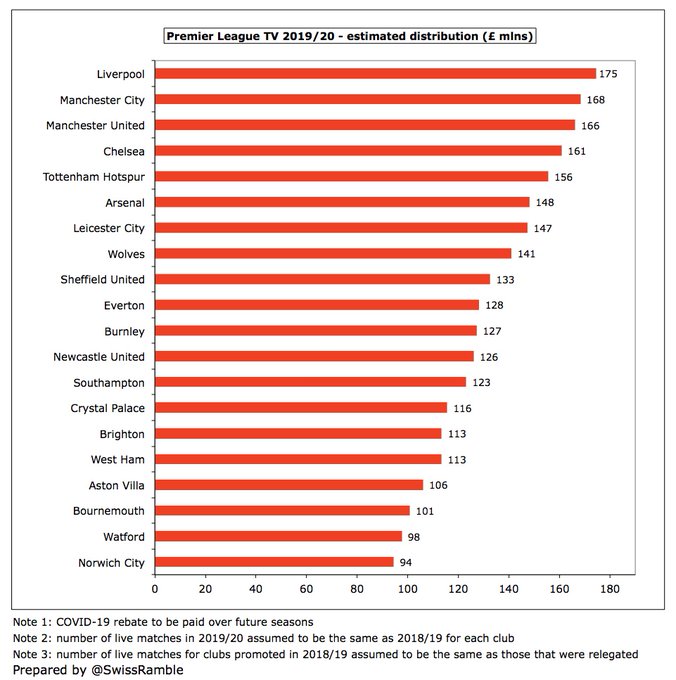

If we assume that the clubs have the same number of games broadcast live in 2019/20 as the previous season, we can estimate the impact of the new deal in 2019/20. Based on this assumption, Liverpool would receive a hefty £175m, followed by Manchester City £168m, Manchester United £166m and Chelsea £161m.

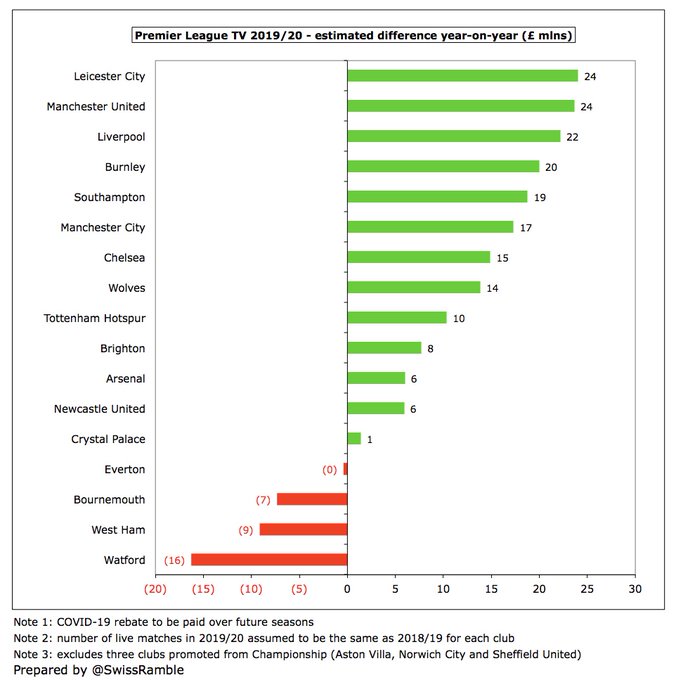

Thanks to the new TV deal, especially the steep increase in overseas rights, this means that most clubs would actually receive more money from Premier League in 2019/20, led by Leicester City £24m, Manchester United £22m and Liverpool £22m. This is also linked to better finishing positions in the league.

The change in distribution for overseas revenue means that final league position is increasingly important. As Richard Scudamore put it, this is “a subtle change that further incentivises on-pitch achievement”, though it is also likely to further grow the gap to the Big Six.

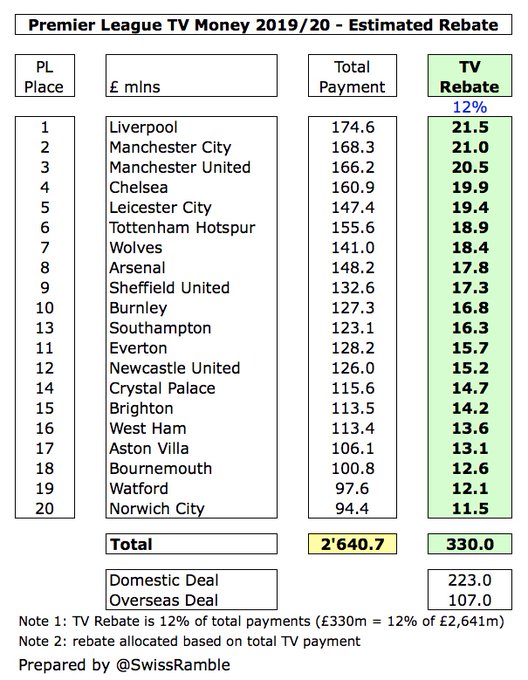

Of course, at some stage the Premier League clubs will have to pay the reported £330m rebate to the TV companies (domestic £223m, overseas £107m)., though only spread over future seasons. That works out to around 12% of the £2.6 bn total anticipated payments.

Comments

Post a Comment