Despite the COVID-19 pandemic, Chelsea have been spending big in this summer’s transfer window with their estimated outlay well over £200m. The authoritative Swiss Ramble has been looking at the financial implications and explains how the club will still be able to meet the Financial Fair Play (FFP) targets.

The impact on Chelsea profit and loss account will be driven by two factors: (a) wages of the new purchases, which the Swiss Ramble has estimated as £42m for the last two years; (b) player amortisation, the annual cost of writing-off transfer fees, which is £53m. This adds up to annual £95m cost.

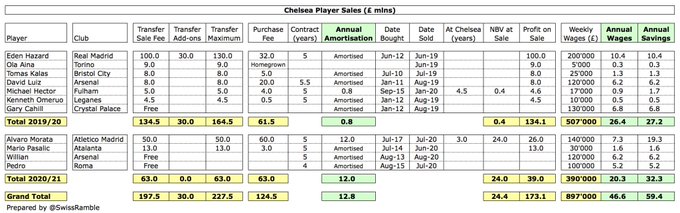

Against that, Chelsea have sold players for £198m over last two years, mainly Eden Hazard £100m (excluding add-ons) and Alvaro Morata £50m, booking an estimated profit from those sales of £173m. The profit is so high, as most departing players were fully amortised in the accounts.

In addition, Chelsea benefit from reducing their wage bill and player amortisation for those exits, even when no transfer fee received, e.g. Gary Cahill, Willian and Pedro. My estimates (last two years) are annual savings of £46m wages and £13m player amortisation, so £59m in total.

The overall result of the club's transfer activity for last 2 years in the accounts is a net cost increase of £36m, with player purchases growing the cost base by £95m, partly offset by £59m reduction from sales. This will be more than offset by £173m profit on player sales.

Over the last six years, they have reported a hefty £494m operating loss, but have largely offset this with an impressive £398m profit from player sales, resulting in pre-tax losses of “only” £108m. Their business model is far more reliant on player sales than any other major English club. In the last six years, their £398m from this activity is nearly £100m more than the next highest (Liverpool and Spurs).

To an extent, Chelsea are also playing catch-up, by spending again after last summer’s FIFA transfer ban, linked to a breach of regulations on registration of Academy players, meant that they were only allowed to spend £40m to acquire previous loanee, Mateo Kovacic.

The other major boost for the club's accounts is their return to the Champions League. In 2018/19 they earned £41m TV money for winning the Europa League, but the Swiss Ramble estimates they will receive £72m for reaching the Champions League last 16 in 2019/20, which is a revenue increase of £31m.

Current FFP rules limit club losses to a maximum €30m over a 3-year monitoring period, so long as €25m of that loss is covered by the owner via an equity purchase, e.g. 2021 monitoring period is 2018, 2019 and 2020. Otherwise, maximum loss (“break-even deficit”) is just €5m. Chelsea had a huge £263m operating loss in last 3 years, but largely offset this with £243m profit on player sales to give a £19m loss before tax. So their £102m loss in 2019 was essentially compensated by £67m profit in 2018 and £16m profit in 2017.

The Swiss Ramble estimates that Cheksea can deduct £81m expenses over the 3-year monitoring period. This was £29m in 18/19, comprising depreciation £9m, amortisation £2m, youth development £10m, community £2m and women’s football £5m. Added to £19m reported loss, this gave £63m break-even surplus.

The club is also protected by changes made to the FFP regulations to account for the Covid-19 pandemic.

Comments

Post a Comment