Which of the three clubs relegated from the Premier League will take the hardest hit? Writing from his Zurich fastness, the Swiss Ramble has some authoritative answers.

Looking at the last reported numbers from 2018/19, it would appear that Bournemouth have most to fear, because they had by far the largest operating loss (£30m) and highest wage bill (£111m). Watford's operating loss was only £6m, while I estimate small profit for Norwich City (pre-COVID).

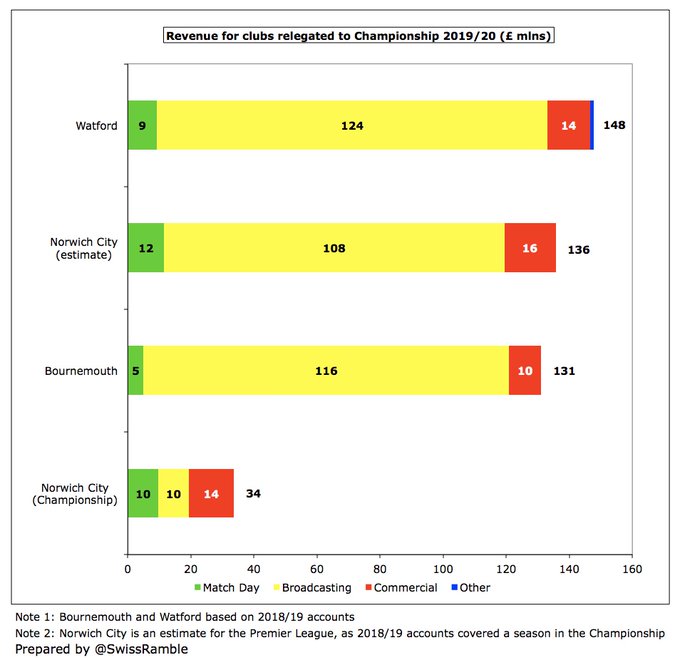

In 2018/19 Watford had the highest revenue of the relegated clubs with £148m, ahead of £136m for Norwich City (estimated, as played in the Championship that season) and £131m for Bournemouth. Revenue will be lower in 2019/20, due to smaller TV money (lower league place) and COVID-19 impact.

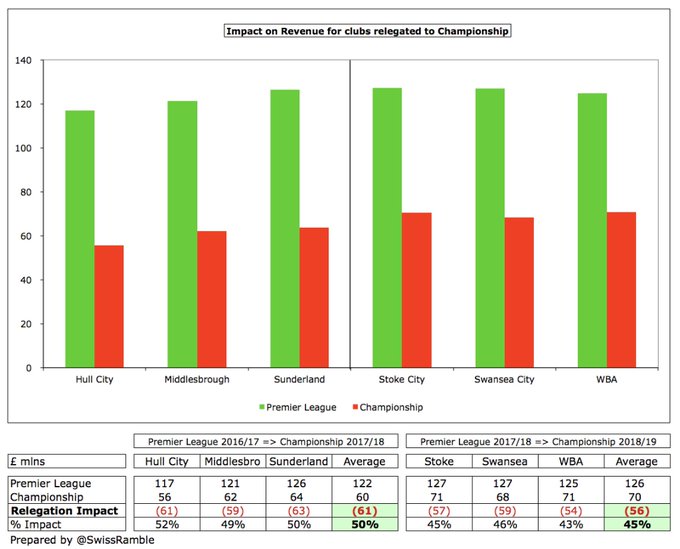

Looking at recently relegated clubs, revenue decrease following relegation ranged from £54m (WBA) to £63m (Sunderland), averaging £61m (50%) in 2017/18 and £56m (45%) in 2018/19. Given the higher revenue in 2019/20 Premier League (pre-COVID), due to new TV deal, the reduction is likely to be around £60m.

Obviously, the most significant revenue decrease is in broadcasting, despite the parachute payments, though clubs can also experience major reductions in the other revenue streams, e.g. Sunderland’s commercial income fell £14m, while Hull City’s match day was down £9m.

On average, broadcasting income drops around £50m following relegation from the Premier League. In 2018/19 this went from an average of £103m to £52m. This will change following the new TV deal in 2019/20, but the magnitude of the fall should be in the same ballpark.

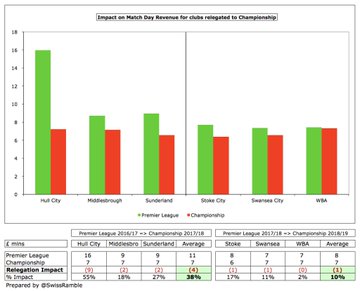

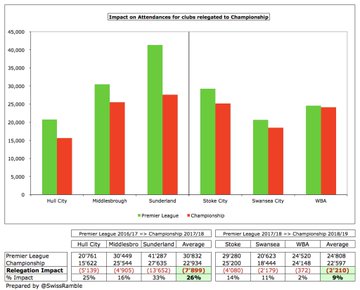

Interestingly, despite fairly large falls in attendance following relegation (9% in 18/19, 26% in 17/18), most clubs did not see dramatic decreases in match day income, partly due to more games in Championship. This fell no more than £2m at 5 clubs with Hull the outlier at £9m.

The decrease in commercial revenue was roughly £5-6m across the board in 2018/19, falling by around a third. It was slightly higher the previous season, very largely due to a chunky reduction at Sunderland. Sponsorship deals often have clauses to cut payments after relegation.

Of course, clubs invariably compensate for lower revenue by cutting the wage bill (many players have relegation clauses in their contracts). As an example, in 2018/19 the decrease in wages averaged £42m (45%), ranging from £38m at Stoke to £45m at WBA.

In fact, in 2018/19 the three relegated clubs actually improved profitability, as the average losses narrowed from £38m to £28m. The previous season, operating loss only rose by £7m from £11m to £18m.

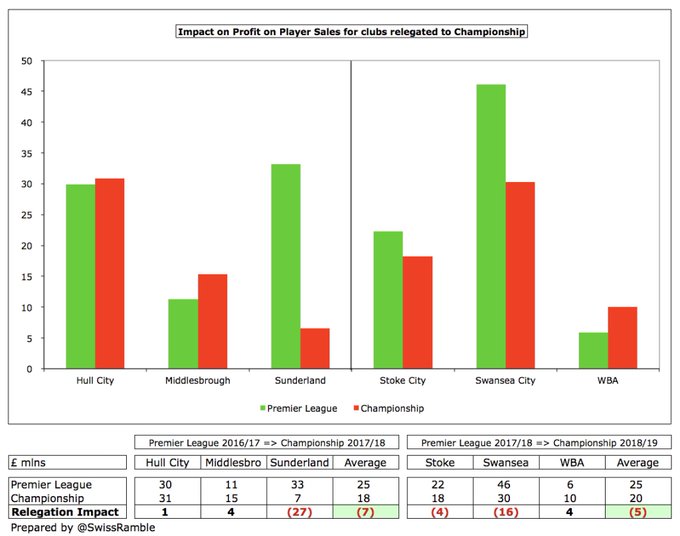

The other concern often voiced about relegated clubs is they will have to sell their best talent to balance the books. While it is true that they have made decent profits here, especially compared to other Championship clubs, average player sales have actually fallen on average.

In conclusion, clubs relegated from Premier League will undoubtedly see a large fall in revenue, but by and large they manage to compensate by cutting wages and other expenses. That said, this only means that their operating losses do not rise much – they do still lose money.

The Swiss Ramble emphasises, 'To be clear, this analysis does not mean that relegation is a good thing financially, especially as parachute payments are only received for 3 years maximum, but it does show that some of the scaremongering that focuses purely on revenue reductions should dig a little deeper.'

Comments

Post a Comment