The authoritative Swiss Ramble has reviewed the third quarter results of Manchester United. He has a two page financial fact sheet on the club available via his Twitter account @SwissRamble.

He comments, 'It is worth noting that Manchester United's £26m profit over nine months in 2019/20 is better than every other Premier League club’s financial result last season, except for Spurs and United. Everything is relative – and half the clubs in the top flight lost money even before Coronavirus.'

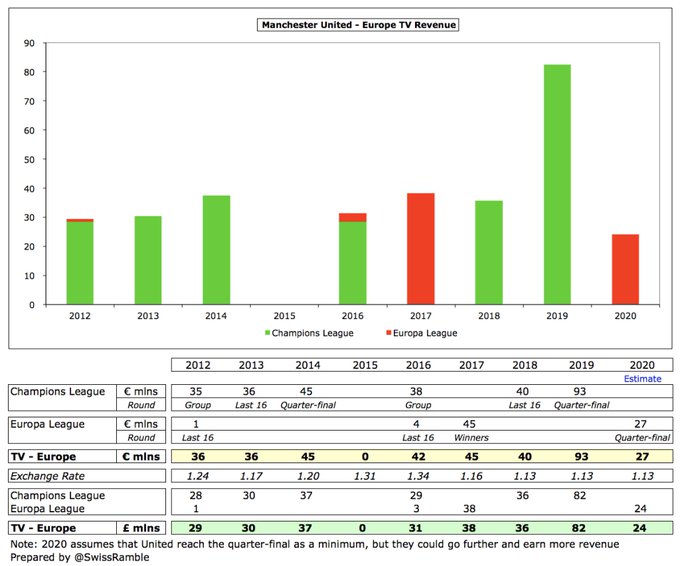

The main reason for the club's £28m revenue reduction was broadcasting, which more than halved from £54m to £26m, due to £15m provision for COVID-19 rebate and playing in the far less lucrative Europa League, compared to the previous season’s Champions League.

Commercial up £2m (3%) to £69m, thanks to new sponsors compensating for lower retail sales, e.g. Old Trafford Megastore closed from mid-March. CFO Cliff Baty said COVID-19 was responsible for £23m of £28m revenue decrease.

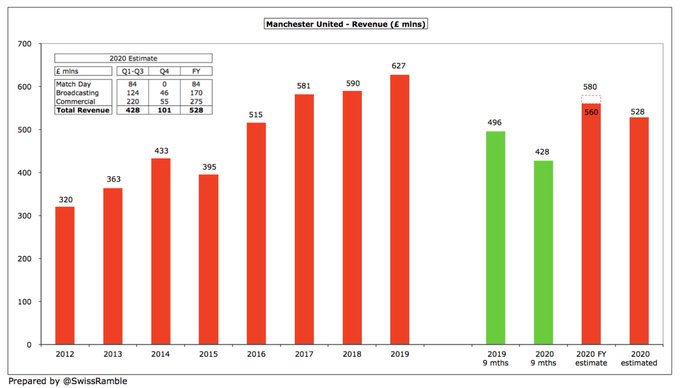

Over nine months United still reported a pre-tax profit, though this dropped £32m from £58m to £26m, as revenue fell £68m (14%) from £496m to £428m and profit on player sales was down £8m to £16m. This was partly offset by a £45m reduction in expenses.

United had already forecast a fall in revenue in 2019/20 from £627m to £560-580m, but are no longer providing guidance, due to COVID-19 uncertainty. The Swiss Ramble comments, 'However, based on a few quick assumptions, I am estimating £528m, which would represent a £99m (16%) decrease from prior season.'

The club lead the way in the Premier League with match day income of £111m, comfortably more than Arsenal £96m, Liverpool £84m, Tottenham Hotspur £82m and Chelsea £67m. Looked at another way, they have more to lose without fans coming to the stadium, though it represents only 18% of total revenue.

Q3 TV income includes £15m provision for the club's share of Premier League rebate to broadcasters, which would mean £20m for the full year. The Swiss Ramble notes, 'This is in line with my model, based on media reports of £330m rebate if games played behind closed doors (original £762m assumed no restart).'

He adds, 'It is worth noting that 2019/20 TV deal is 8% higher than previous season (domestic down 7%, overseas up 34%), so loss compared to 2018/19 would be partially offset, especially as overseas increase is based on league position, e.g. United's loss would be net £2m (instead of £20m).'

Broadcasting contributes just 38% to their total revenue, which is the lowest in the Premier League. A rebate is much more of an issue for other clubs, as they are hugely dependent on TV money, e.g. it’s 88% of Bournemouth's total.

The main driver for lower United TV money in 2019/20 is playing in the Europa League instead of the far more lucrative Champions League. They earned £82m for reaching the CL quarter-finals in 2018/19, but to date have only earned an estimated £24m in the EL this season.

United's revenue advantage over other clubs has traditionally been due to their commercial prowess, which generated £275m revenue in 2018/19, well ahead of Manchester City £227m, Liverpool £188m and Chelsea £180m. Includes huge sponsorship deals with Adidas £75m and Chevrolet £64m. Their commercial income was flat for last 4 years, but 2019/20 is up, thanks to new sponsors, so first nine months saw 5% increase to £220m. However, lockdown likely means a fall in Q4, due to lower exposure and retail sales. Assuming 20% cut would give £275m (same as last year).

These assumptions suggest COVID-19 revenue impact of £55m in 2019/20, though likely to be higher next season. Estimated at £135m: match day £64m (games behind closed doors until January); broadcasting £20m (same as this season); no pre-season tour £11m; commercial £40m (15% cut).

It is possible that the broadcasters would push for higher rebates if they felt the “product” was compromised by no fans at the grounds.

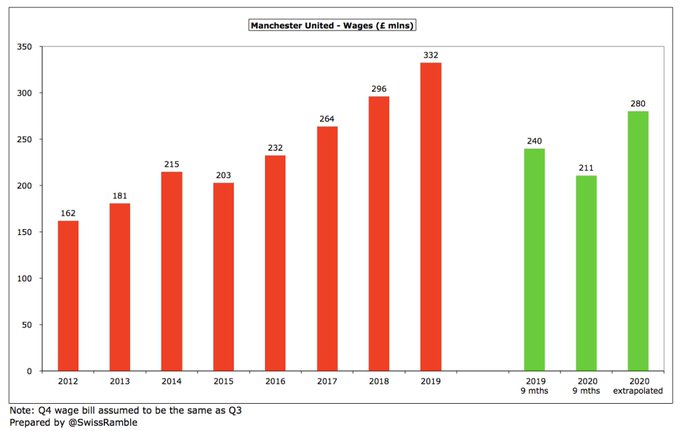

Wage bill cut by £29m (12%) from £240m to £211m in first nine months of 2019/20, mainly due to lower bonuses for non-participation in the Champions League and player departures. Assuming Q4 is the same as Q3 (£69m), full year would be £280m, £52m (16%) lower than prior season.

In 2018/19 United's £332m was highest wage bill in the Premier League, ahead of Manchester City £315m, Liverpool £310m and Chelsea £286m, though it will be interesting to see this season’s rankings, as those three clubs all qualified for the Champions League, while United are only in the Europa League.

Debt is still very high at over half a billion pounds, even after all the various refinancings by the Glazer family. It is only surpassed by Spurs £658m – and that was for building their new stadium, as opposed to financing a leveraged buy-out.

Comments

Post a Comment