Writing from his Zurich fastness, the authoritative Swiss Ramble compares the 2018/19 finances of the Big Six Premier League clubs with the rest.

He states: 'The Big 6 were more profitable than Other 14 on most metrics: EBITDA around twice as much (£716m vs £324m); operating loss much smaller (£97m vs £393m); £33m profit before tax vs £188m loss. The only exception was profit on player sales, where the other 14 were higher (£241m vs £193m). This was on a "needs must" basis.'

Thanks to player sales, Premier League clubs have largely managed to post pre-tax profits in last eight years: Big 6 every season since 2013; Other 14 losses come in third year of TV deal.

However, Big 6 profitability dropped more than other 14 against prior year, especially pre-tax profit, falling £406m from £439m to £33m, while the other 14 “only” decreased £221m, albeit moving from £33m profit to £188m loss.

Big 6 and Other 14 tend to report operating losses with the best performance in the first year of 3-year Premier League TV deal (2014 and particularly 2017). However, Big 6 have reduced loss from £159m in 2012 to £97m in 2019, while Other 14 loss has doubled from £186m to £393m.

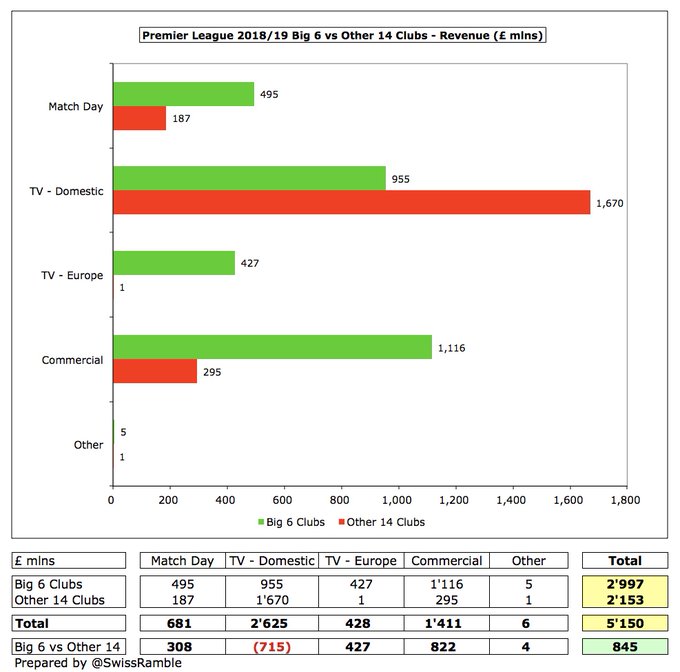

Big 6 £3.0 bn revenue is £845m more than Other 14 £2.2 bn (58% vs 42% of £5.2 bn total). Big 6 is higher than Other 14 for almost all revenue streams: commercial £822m, Europe TV £427m and match day £308m. The only exception is domestic TV, where Other 14 are £715m higher.

Premier League revenue grew £342m in 2019 over prior year with Big 6 £240m growth over twice as much as Other 14 £103m, largely driven by new UEFA TV deals (£118m vs minus £12m) and commercial deals (£72m vs £47m).

Although Big 6 and Other 14 revenue has grown at much the same rate (around 120%) since 2012, the gap has widened by almost half a billion pounds, increasing from £373m to £845m. Big 6 58% revenue share in 2019 is highest since 59% in 2013.

The gap between the 6th and 7th highest Premier League clubs by revenue has never been higher, rising from £190m to £204m in 2019.

The 6th highest Premier League club by revenue, namely Arsenal, saw its European TV revenue drop to £34m in 2019, but this was still £34m higher than the 7th placed club West Ham, as they did not qualify for Europe

European competition has always been a huge differentiator for the Big 6, but the gap in 2019 is colossal: £427m vs just £1m.

Similar to revenue, Big 6 expenses are invariably higher than Other 14, notably wages (£1.7 bn vs £1.5 bn). Interestingly, since 2012 wages growth at Big 6 (£771m) and Other 14 (£724m) has been very similar, both having nearly doubled in this period, though the gap widened in 2019 to £192m.

Although wages to turnover ratios worsened in 2019 (Big 6 from 52% to 55%, Other 14 from 67% to 68%), it is interesting that these have improved since 2012 (Big 6 down from 65%, Other 14 from 75%).

In contrast to revenue, the gap between the 6th and 7th highest wages clubs in the Premier League has not really grown much in the last few years.

However, small wages gap is also due to Tottenham Hotspur’s frugal approach, so it’s worth also looking at the gap between the 5th and 7th placed clubs. Here, the gap has increased since 2010 from £31m to £72m (Arsenal £232m vs Everton £160m), though has narrowed in last 3 years from £102m peak.

Big 6 other operating expenses have risen by £312m in the last seven years from £319m to £631m in 2019, while Other 14 are up £169m from £218m to £387m in the same period. As a result, the gap has substantially widened from £102m to £244m.

Comments

Post a Comment