Crystal Palace turned a £36m loss into a £5m profit in 2018/19 and the authoritative Swiss Ramble explains how they did it. For Palace fans an overview is available in the form of a two page fact sheet via the Swiss Ramble's Twitter account @SwissRamble.

Kieran Maguire's Price of Football site has also provided an analysis of Palace finances: http://priceoffootball.com/crystal-palace-2018-19-dissidents/

Writing from his Zurich fastness, the Swiss Ramble states 'very largely due to profit on player sales (mainly Aaron Wan-Bissaka’s move to United) surging from £2m to £46m, though revenue also rose £5m (3%) to a club record £155m. Partly offset by expenses increasing £8m.'

Player sales significantly improved from a very low £2m to £46m, mainly due to the lucrative Wan-Bissaka transfer. This was 3rd highest in the Premier League, only surpassed by Chelsea £60m and Leicester City £58m.

The Eagles have made £83m from player sales in the last three seasons. Excluding £46m from this activity in 2018/19, the club would have lost £41m. As chairman Steve Parish said, 'We would prefer to hold onto our key players, but compliance with FFP is a major consideration.'

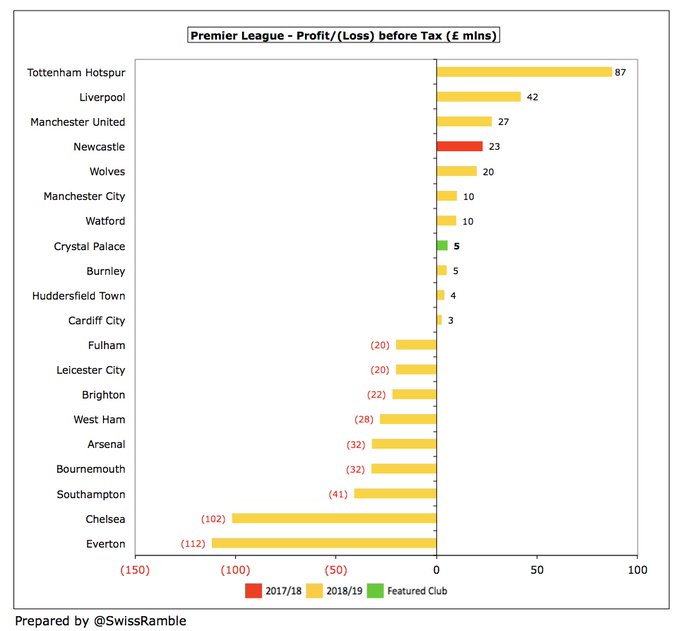

The football finance guru notes, '£5m profit may not be huge, but this was actually the 8th best financial performance in the Premier League. No fewer than nine clubs posted a loss, including two above £100m, namely Everton £112m and Chelsea £102m. This is a far cry from prior season, when Palace had the largest loss.'

He adds, 'After promotion to the Premier League in 2013, Palace have made money in four of the six seasons since then. Over that period, their aggregate profit was £6m, i.e. £1m a season (essentially break-even), which is not too shabby, given the need to compete with bigger spending clubs.'

All three Palace revenue streams grew, led by broadcasting, which rose £3.2m (3%) to £124.4m. There were also increases in commercial, up £1.0m (6%) to £16.4m, and match day, up £0.9m (7%) to £14.6m.

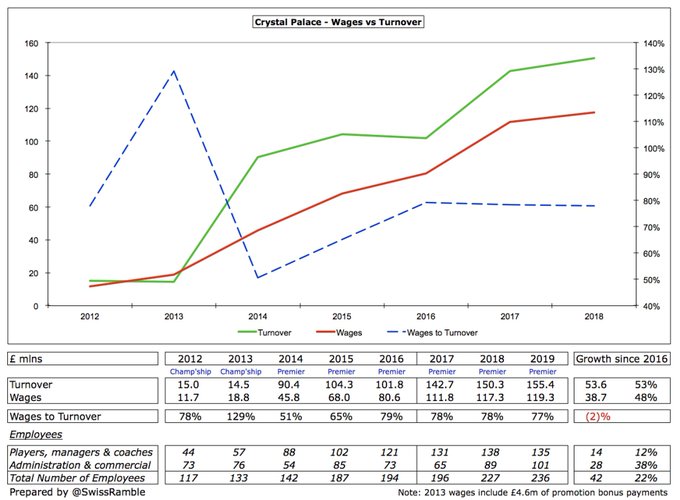

Revenue has grown by £54m (53%) in the last 3 years from £102m to £155m. Most of this growth (£46m) can be ascribed to the new Premier League TV deal in 2017, but worth noting that commercial is also up £7m (60%), while match day is essentially flat. Nevertheless, crowds have grown by 47 per cent since promotion from the Championship. [Stadium redevelopment may be the key to improvement here, as the crowd certainly does not lack passion - WG]

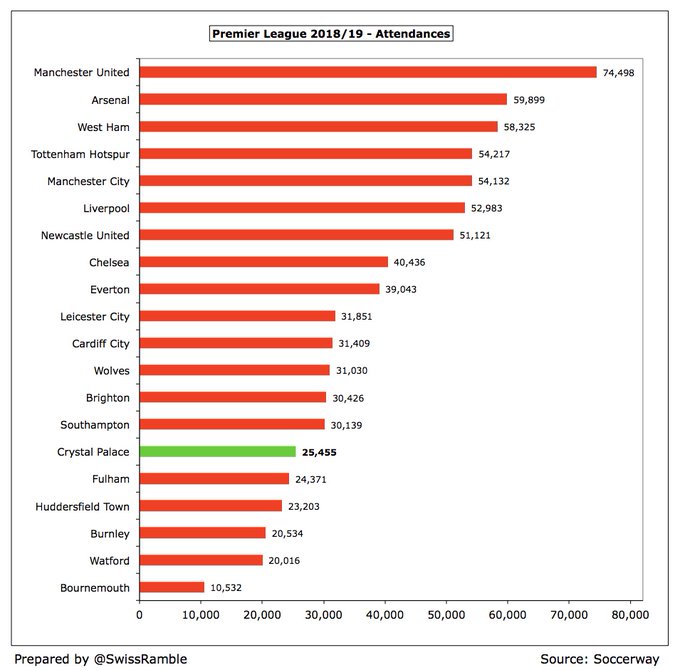

Average attendance of 25,455 was the 15th highest in the Premier League, but nearly 100% of capacity, which helps explain the club’s decision to build a new main stand at Selhurst Park to increase capacity from 25,486 to 34,000. The stadium project expected to cost £130m. Probably only ready for 2022/23 season, given COVID delays. The club say it 'will offer a step change in revenue potential with over 8,300 new seats, up to 3,000 new premium covers and major opportunities for non-matchday revenue.'

Chairman Steve Parish has stressed its long-term importance for the club: 'To be competitive, we need as much revenue as possible and other Premier League clubs have £20m-£30m more revenue than

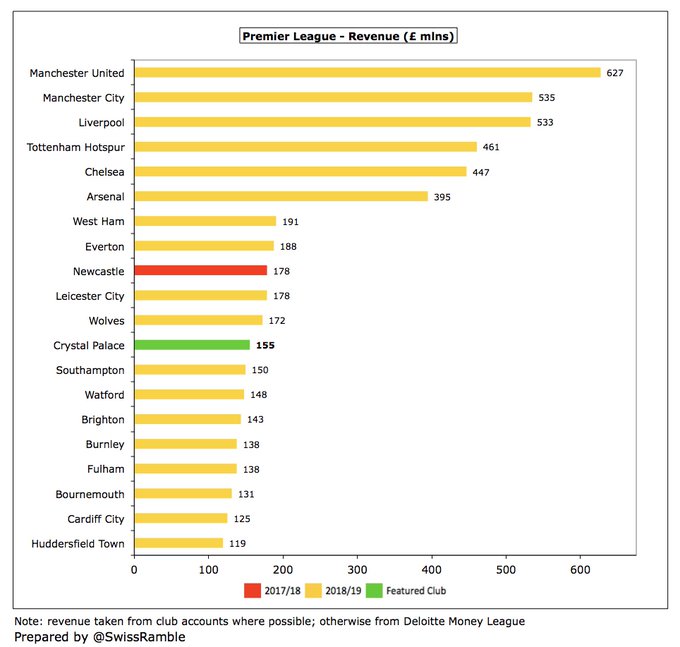

Palace.'.£155m revenue is the 12th highest in the Premier League, exactly in line with their final league position. However, for perspective it’s £240m below the Big Six (Arsenal £395m) and only around a quarter of United £627m. More pertinently, it’s £17m less than 11th placed Wolves.

Although a substantial 80% of club revenue came from TV (£124m out of £155m), this is far from unusual in the Premier League, as no fewer than 13 of the 20 clubs are above 70% with Bournemouth “leading the way” with an amazing 88%.

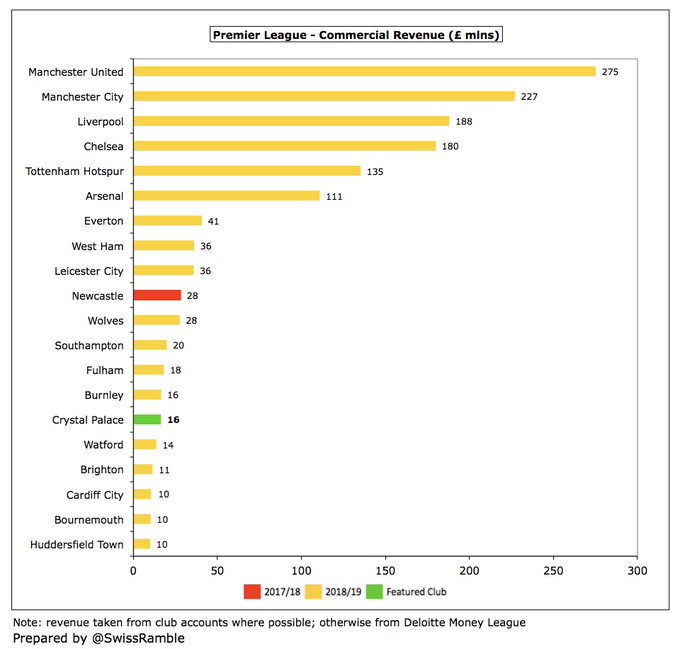

Commercial revenue has grown by two-thirds in the last 3 years, but is still only 15th highest in the Premier League, sandwiched between Burnley and Watford. [For some reason it is always seen as more fashionable to be north of the Thames - WG].

Wages have grown by £39m (48%) in the last 3 years, pretty much the same rate as revenue. The £119m wage bill is the 10th highest in the Premier League, only surpassed by the Big Six plus Everton, Leicester and West Ham. This is higher than might be expected, given that the club’s revenue is 10th highest, but not wildly out of line. The wages to turnover ratio of 77 per cent is above the Uefa recommended level of 70 per cent.

Comments

Post a Comment